The transfer of funds can be made by payment service providers (credit institutions, payment institutions and electronic money institutions), based on a payment order sent via payment instruments (credit transfer, direct debit, payment card, cheque, bill of exchange and promissory note) to these.

Making a cashless payment via funds transfer from the payer to the payee involves a series of operations which may be performed only by payment service providers.

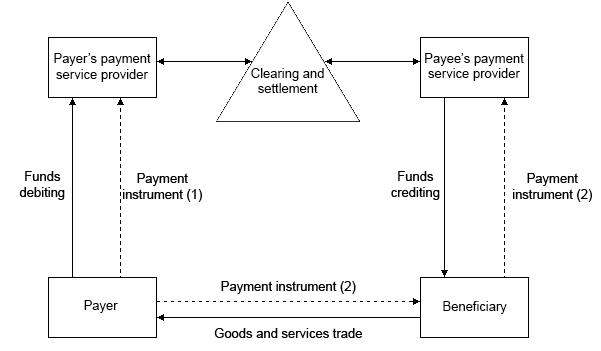

The main phases of a cashless payment are as follows:

The transactional phase consists of the initiation, validation and transmission of a payment instruction. Based on the instrument type, the payment instruction may be initiated by the payer (e.g. in the case of the credit transfer), see in the figure payment instrument (1) or by the beneficiary (e.g. in the case of direct debit), see in the figure payment instrument (2). This phase includes several operations which are mainly aimed at checking the identity of the payment service user, the validity of a specific payment’ use instrument, including personalized credential of the payment service user.

During the clearing and settlement phase, the participants in the clearing-settlement system exchange payment messages via the retail payment system. The net positions resulting from clearing phase are settled via the large-value payment system considering the payment currency (ReGIS processing LEI payments or TARGET2 processing EURO payments).