At end-September 2017, broad money (M3) amounted to RON 332,305.1 million, up 0.6 percent (0.1 percent in real terms) month on month. In year-on-year comparison, broad money rose 12.3 percent (10.3 percent in real terms).

Table 1. Monetary aggregates*

| INDICATORS |

30 September 2017

(RON mill.) |

Sep. 2017/

Aug. 2017

% |

Sep. 2017/

Sep. 2016

% |

| M1 (narrow money)

| 199,859.4

| 0.6

| 21.8 |

| Currency in circulation

| 61,552.9

| 1.3

| 18.9 |

| Overnight deposits**

| 138,306.5

| 0.3

| 23.1 |

| M2 (intermediate money)

| 332,177.5

| 0.6

| 12.3 |

| M1

| 199,859.4

| 0.6

| 21.8 |

| Deposits with an agreed maturity of up to and including two years (includes also deposits redeemable at a period of notice of up to and including three months)

| 132,318.1

| 0.6

| 0.4 |

| M3 (broad money)

| 332,305.1

| 0.6

| 12.3 |

| M2

| 332,177.5

| 0.6

| 12.3 |

| Other marketable instruments (repurchase agreements, money market fund shares and units, marketable securities with a maturity of up to and including two years)

| 127.6

| -0.5

| 25.2 |

* provisional data

** currency outside banks

***current accounts, demand deposits

Table 2. Broad money and its counterpart*

| INDICATORS |

30 September 2017

(RON mill.) |

Sep. 2017/

Aug. 2017

% |

Sep. 2017/

Sep. 2016

% |

| Broad money (M3)

| 332,305.1

| 0.6

| 12.3 |

| Net foreign assets **

| 149,954.6

| -4.8

| 10.9 |

| Net domestic assets ***

| 182,350.5

| 5.5

| 13.4 |

* provisional data

** after deducting foreign liabilities from foreign assets.

Foreign assets include: loans granted to non-residents; deposits with non-residents; debt securities held (issued by non-residents); shares and other equity with non-residents; monetary gold.

Foreign liabilities include funds raised from non-residents: deposits; negotiable debt securities issued on external markets. Starting December 2014, according to the new international statistical standards (ESA 2010), the IMF’s SDR allocations are included in foreign liabilities.

*** after deducting domestic liabilities (except M3 components) from domestic assets.

Domestic assets include: loans granted to residents; negotiable debt securities held (issued by residents); shares and other equity with residents.

Domestic liabilities (except M3 components) include funds raised from residents: deposits with an original maturity of over two years (including deposits redeemable at notice over three months); negotiable debt securities with an original maturity of over two years issued on the domestic market; capital and reserves.

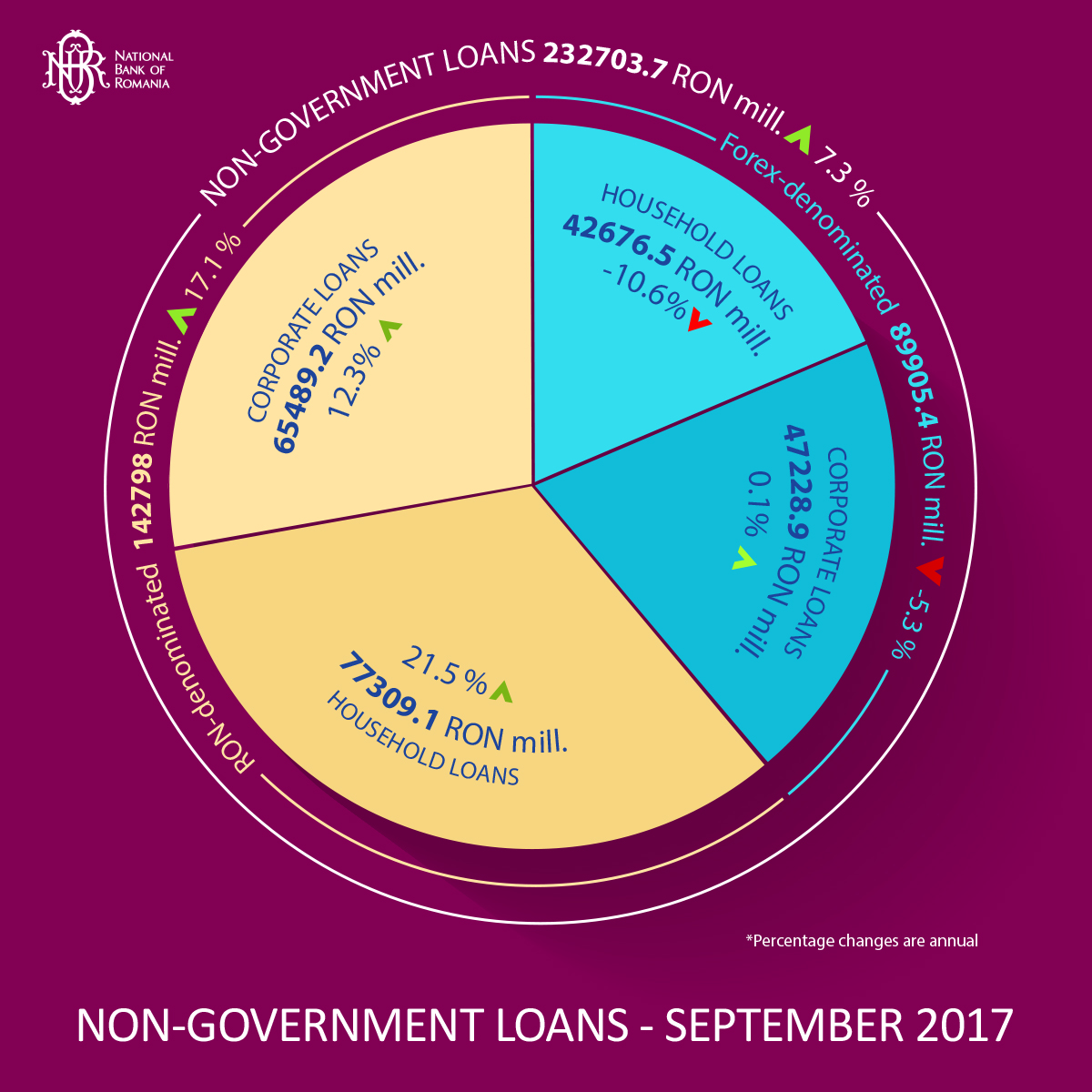

At end-September 2017, non-government loans granted by credit institutions inched up 1.4 percent (0.9 percent in real terms) from August 2017 to RON 232,703.7 million. RON-denominated loans expanded 1.9 percent (1.4 percent in real terms), whereas foreign currency-denominated loans rose 0.6 percent when expressed in RON and 0.4 percent when expressed in EUR. At end-September 2017, non-government loans went up 7.3 percent (5.4 percent in real terms) year on year, on the back of the 17.1 percent increase in RON-denominated loans (15.1 percent in real terms) and the 5.3 percent decline in foreign currency-denominated loans expressed in RON (when expressed in EUR, forex loans dropped 8.3 percent).

Table 3. Non-government loans*

| INDICATORS |

30 September 2017

(RON mill.) |

Sep. 2017/

Aug. 2017

% |

Sep. 2017/

Sep. 2016

% |

| Non-government loans (total)

| 232,703.7

| 1.4

| 7.3 |

| RON-denominated non-government loans:

| 142,798.3

| 1.9

| 17.1 |

| - household loans

| 77,309.1

| 1.4

| 21.5 |

| - corporate loans (non-financial corporations and non-monetary financial institutions)

| 65,489.2

| 2.6

| 12.3 |

| Forex-denominated non-government loans:

| 89,905.4

| 0.6

| -5.3 |

| - household loans

| 42,676.5

| -0.9

| -10.6 |

| - corporate loans (non-financial corporations and non-monetary financial institutions)

| 47,228.9

| 2.0

| 0.1 |

* provisional data

** non-performing loans are also included

Government credit1 added 0.3 percent in September 2017 from a month earlier to RON 97,267.2 million. At end-September 2017, government credit advanced 9.4 percent (7.5 percent in real terms) versus the same year-ago period.

Deposits of non-government resident customers went up 0.5 percent month on month to RON 286,385.5 million in September 2017.

Table 4. Deposits of non-government resident customers*

| INDICATORS |

30 September 2017

(RON mill.) |

Sep. 2017/

Aug. 2017

% |

Sep. 2017/

Sep. 2016

% |

| Deposits of non-government resident customers (total) **

| 286,385.5

| 0.5

| 10.8 |

| RON-denominated deposits of residents:

| 194,052.9

| 0.1

| 11.3 |

| - household deposits

| 107,528.5

| 0.0

| 10.8 |

| - corporate deposits (non-financial corporations and non-monetary financial institutions)

| 86,524.4

| 0.3

| 12.0 |

| Forex-denominated deposits of residents:

| 92,332.6

| 1.3

| 9.6 |

| - household deposits

| 63,634.9

| 1.2

| 11.3 |

| - corporate deposits (non-financial corporations and non-monetary financial institutions)

| 28,697.7

| 1.5

| 6.2 |

* provisional data

** includes current accounts, demand deposits and all time deposits, irrespective of maturity

RON-denominated household deposits decreased by RON 6.7 million to RON 107,528.5 million. At end-September 2017, household deposits in domestic currency rose by 10.8 percent (8.8 percent in real terms) against end-September 2016.

RON-denominated corporate deposits (non-financial corporations and non-monetary financial institutions) moved up 0.3 percent to RON 86,524.4 million. At end-September 2017, RON-denominated corporate deposits climbed by 12.0 percent (10.1 percent in real terms) year on year.

Forex-denominated deposits of resident households and companies (non-financial corporations and non-monetary financial institutions) added 1.3 percent to RON 92,332.6 million when expressed in domestic currency (when expressed in EUR, forex deposits moved ahead 1.1 percent to EUR 20,076.2 million). In year-on-year comparison, residents’ forex deposits expressed in RON advanced 9.6 percent (when expressed in EUR, residents’ forex deposits rose by 6.1 percent); household forex deposits climbed by 11.3 percent when expressed in domestic currency (when expressed in EUR, household forex deposits expanded by 7.7 percent) and forex deposits of legal entities (non-financial corporations and non-monetary financial institutions) edged up 6.2 percent when expressed in RON (when expressed in EUR, forex deposits of resident legal entities stood 2.8 percent higher).

1 includes credit to general government includes credit to general government (central government, local government and social security funds) in amount of RON 10,012.5 million and debt securities issued by these institutional sectors running at RON 87,254.7 million (outstanding as at end-September 2017).

Methodological notes

In the monetary balance sheets of monetary financial institutions, the accrued interest receivable/payable related to financial assets and liabilities is recorded under remaining assets/remaining liabilities.

Data for preparing monetary indicators are reported by monetary financial institutions in accordance with NBR Regulation No. 4/2014 on reporting statistical data and information to the National Bank of Romania, as subsequently amended and supplemented, Title I, Chapters I and II.

The statistical data are provisional and may be subject to periodic review. Series of indicators (available from February 2007) can be accessed in various formats (html, xls, xml and csv) in the interactive database. Statistical data series including monetary aggregates and non-government loans expressed as a share of GDP can be accessed here.

The next press release on monetary indicators will be issued on 24 November 2017.

Press release archive.